Rates 2024/25

District Rate 2024-2025

Fermanagh and Omagh District Council has agreed a District Rate increase of 4.72% for domestic (residential) and non-domestic (business) properties for 2024-2025. This represents:

- An increase of £1.83 per month for the average domestic (residential) property with a capital value of £115,000 on the 2024-2025 District Rate portion of the rates bill.

- An extra £9.58 per month for non-domestic (business) properties with an average net annual value of £10,000, on the 2024-2025 District Rate portion of the rates bill.

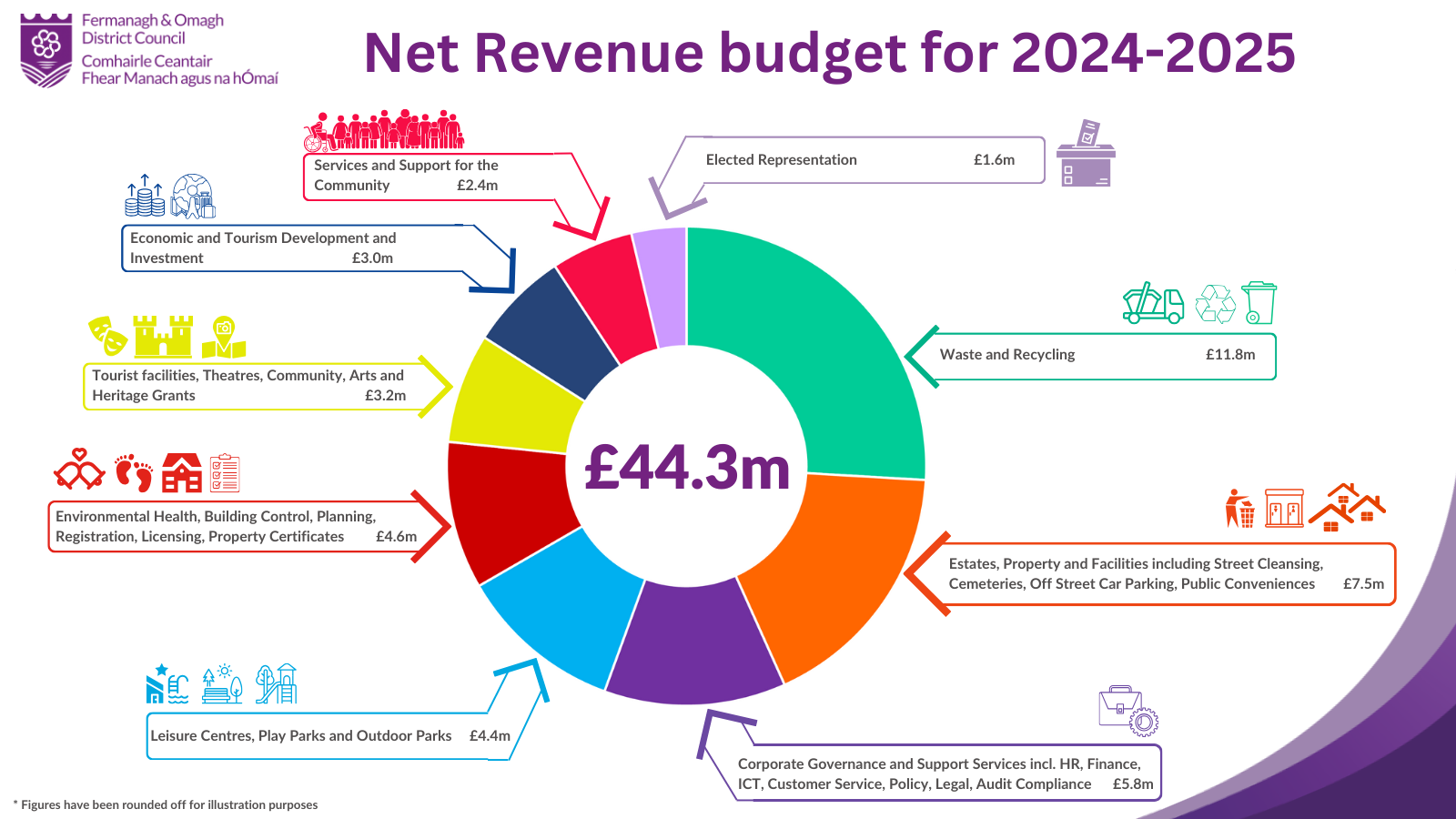

Net revenue budget 2024-2025

The setting of the District Rate will generate approximately £43.1m of rates income to support the delivery of key services across the Fermanagh and Omagh district in 2024-2025 and meet the Council’s priorities as set out in the Fermanagh and Omagh Community Plan 2030 and the Council’s Corporate Plan.

Capital programme

The Council plans for an ambitious £13.75m capital investment programme in 2024-2025 to improve local infrastructure and facilities for the benefit of all.

Almost half the cost of the capital investment programme attracts external funding opportunities to further minimise the cost to ratepayers.

In total, £7.75m of the projects attract £6.4m external funding, including the proposed redevelopment of the Fermanagh Lakeland Forum which is subject to approval by Council of a Full Business Case and, which if approved, will secure total Levelling Up Fund (LUF) funding of £20m.

Other proposed capital projects (£6m) are Council funded. These include:

- ongoing delivery of the Council’s Play Strategy to upgrade play areas across the district;

- Strategic Capital Projects and Community Capital Grants;

- leisure centre upgrade works across the District;

- essential investment in new vehicles, equipment and plant to further support service delivery; and

- development works at waste facilities.

How we use your rates 2024-2025

45% of your total rates bill is paid to Fermanagh and Omagh District Council to pay for the delivery of key services across the Fermanagh and Omagh district and a capital programme to improve local facilities and infrastructure. The remaining 55% is paid to Central Government.

A ‘How we use your rates’ online tool is available on the Council website to see how much of your rates is used to fund local Council services.

Frequently Asked Questions - Rates 2024-2025

1. How much will my rates increase by in 2024-2025?

Not accounting for any adjustment on the Regional Rate which remains unknown, the District Rate Poundage on the rates bill will be 0.4223p (increase 4.72% on previous year) for Domestic (residential) rates and 25.570p (increase 4.72% on previous year) for Non-Domestic (business) rates.

The Department of Finance has not yet released its rate poundage for the Regional Rate element of the rates bill.

2. How much more per year will I have to pay as a result of the increase?

The District Rate element of the rates bill will increase by £1.83 per month for the average domestic (residential) property with a capital value of £115,000 in 2024-2025.

The District Rate element of the rates bill will increase by £9.58 per month for a non-domestic (business) property with a net annual value of £10,000 in 2024-2025.

3. Why are the rates increasing from 01 April 2024?

Like residents and businesses, the Council is also experiencing the same ongoing cost pressures linked to current external market conditions, including high inflation and high interest rates. Funding from Central Government has also reduced.

Councillors and Council Officers have undertaken significant work to minimise the impact on ratepayers of these additional cost pressures and reduction in Central Government funding by making budget savings of £1.3m and using £1m from the Covid reserve for the 2024-2025 budget.

The increase in the District Rate will enable the Council to continue to deliver core and statutory services and a provide a range of supports to communities and businesses. It will also enable investment in our communities through the delivery of a £13.75m Capital Programme (with 46% of this attracting external funding).

4. How much money will be generated for the Council by the 2024-2025 rates bill?

It is estimated that £43.1 million will be raised through the rates in the 2024-2025 financial year.

5. Why does my rates bill increase every year?

The Council is a service based organisation and, similar to all service providers, there are costs to deliver these services which increase on a yearly basis in line with inflation.

The Council is also facing continued reduction in the annual Rates Support Grant from Central Government through the Department for Communities, which provides the Council with financial assistance to help minimise the impact of the rates on ratepayers. The Council is also experiencing other reductions in central government grants linked to direct service provision.

The ongoing financial challenges and cost increases which the Council is required to meet contribute to an increase in the rates to enable the Council to continue to deliver core services as well as a range of additional services for the benefit of residents and businesses.

Any reduction in the District Rate could impact on services, for example, the closure or reduced operation of venues and facilities; grant funding which supports local community groups and businesses could be reduced; and there could be job losses.

6. Who sets the rates?

The District Rate is set by the Council. It is approved by Councillors at a Special Council meeting in February each year. Councillors, with assistance from Council Officers, review the budgets for service delivery and the capital programme, as well as income received from the District Rate and other sources, to agree the District Rate.

The Regional Rate is set by the Northern Ireland Executive. The Council has no input to this process.

7. How are the rates calculated?

The District Rate and the Regional Rate are combined and multiplied by the rateable value of your property to determine your rates bill.

You can work out your total rates bill by using the Department of Finance’s online property valuation tool.

8. Does the Council receive the full amount of money paid through the rates?

No. The Council receives approximately 45% of the income raised through the overall rates bill.

The remaining 55% is paid to Central Government.

The allocation of rates to the Council is determined by the increase in the District Rate, agreed by the Council on an annual basis.

9. Why is there a District Rate and a Regional Rate? What are they used for?

The District Rate is set by the Council in February each year to pay for the delivery of local core and statutory services i.e. services it is legally required to deliver, as well as a capital programme to improve facilities and infrastructure across the district.

Core and statutory services include:

- Waste collection and disposal

- Environmental Health (including Food Control, Health & Safety, Consumer Protection, Environmental Protection, Public Health, Housing, Planning and Health Improvement)

- Registration of births, deaths marriages and civil partnerships

- Planning

- Building Control

- Cemeteries

The Council also provides a number of additional services for the benefit of residents and businesses and to enhance the District. These services include:

- Household recycling centres

- Street cleansing

- Public conveniences

- Parks and play parks

- Off Street Car Parking (car parks)

- Economic and tourism development

- Community events

- Community support services including grant funding

- Leisure and recreation facilities

- Arts, cultural, heritage and tourist facilities

- Capital projects and capital grants, supporting investment in our communities.

A ‘How we use your rates’ online tool is available on the Council website. Here you can enter your total rates value for the year to see the exact contribution you make to the Council to fund local services.

The Regional Rate is set by the Northern Ireland Executive to contribute to the delivery of services including:

- Roads

- Education

- Health

- Emergency services

- Law and order

- Social services.

The Council has no input in the Regional Rate process.

10. How does the Council decide on its priorities for expenditure from the rates it receives?

The Council’s priorities are set out in the Fermanagh and Omagh Community Plan 2030 and the Council’s Corporate Plan.

Councillors prioritise expenditure on the delivery of core and statutory services which it is legally required to deliver such as Waste collection and disposal; Registration of births, deaths, marriages and civil partnerships; Environmental Health; Planning; Building Control and Cemeteries, as well as a range of additional services and investment projects to improve the whole district, strengthen local communities and enhance the wellbeing of residents.

11. Can the Council address issues such as the maintenance of roads, pavements and grass verges and health care?

No. The Council is not responsible for roads infrastructure or health. These are the responsibility of Central Government departments. The Department for Infrastructure is the responsible body for roads, pavements and grass verges. The Department of Health is the responsible body for health care services.

12. Why does the District Rate vary between each Council?

Each Council sets its own District Rate, depending on its priorities. The legislative date for ‘striking’ the District Rate is by 15 February each year.

13. Can the Council use money from its reserves, or any surplus from the previous year’s budget, to offset an increase in the District Rate?

Council reserves have been established under relevant legislation and regulation to fund future specific expenditure. The Council has and continues to use available reserves to minimise the impact on ratepayers and is using £1m from the Covid reserve in 2024-2025 budget to do this.

The Council also considers its actual financial position compared to its budgeted position on an annual basis. It then determines the allocation of any surplus to its usable reserves, in line with the Council’s Financial Reserves Policy.

14. Who has to pay rates and what happens if I cannot afford to pay my rates?

Domestic (residential) rates bills are issued by Land and Property Services to all residential properties in Northern Ireland. Land and Property Services has rates reliefs available for some homeowners who are entitled to help with paying rates. You can find out more about this on the nidirect website.

Non-domestic (business) rates are required to be paid on business properties, unless they are registered for charitable or religious purposes. Land and Property Services has a number of reliefs available to business ratepayers. You can find out more about this on the Department for Finance website.

15. I am renting my accommodation, who is responsible for paying the rates bill?

The owner of a rental property is responsible for paying the rates bill.

16. When do I receive my rates bill and how can I make payment?

Land and Property Services generally issue rates bills in April each year. It is also responsible for collecting rates monies. Payment can be made in one lump sum or by direct debit over 10 months. Information on how and when to pay your rates as well as support which is available is detailed on your rates bill.

17. What is a rates revaluation and what impact does this have on my rates bill?

NIReval 2023 is a revaluation of non-domestic properties to bring the rateable values into line with property rental values. It helps to ensure that business rates stay up to date and reflect economic, social and environmental changes by distributing the rates liability equitably and fairly across all sectors.

Land and Property Services have contacted all non-domestic ratepayers in relation to the impact of the NIReval 2023. Since 2020, the value of your business property will have increased, decreased or stayed the same and this is separate to any increase in District or Regional rates increases each year.

The impact on individual rates bills will be included in your next rates bill.

18. I have a query about my rates bill, who do I contact?

Rates are managed by Land and Property Services, therefore, if you have a query you should contact them on 0300 200 7801 or visit the nidirect website.

19. I have a query about the value of my property, who do I contact?

Rates are managed by Land and Property Services, therefore, if you have a query you should contact them on 0300 200 7801 or visit the property valuation section on the Department for Finance website.

Further information

For further information about rates, including valuations of properties and rates relief for householders and businesses, please contact Land and Property Services by calling 0300 200 7801 or visit the nidirect website.

The Department for Communities – General Estimates of Rates 2024/2025 is available to download.